How It Works

Our simple process will help you get the compensation you deserve while minimising stress and hassle. Check your eligibility online, leave your details with us, and we’ll handle the rest. This guide tells you more about the claiming process and what you can expect.

A Rundown of the Process

If you believe you are a victim of car finance mis-selling, a compensation claim will help you get justice and financial redress. The claim process might seem complex and overwhelming, but that shouldn’t stop you from seeking the compensation you’re owed. Working with us, your journey to a successful claim can be seamless and hassle-free.

Below, we break down some of the steps in the compensation process to help you know what to expect.

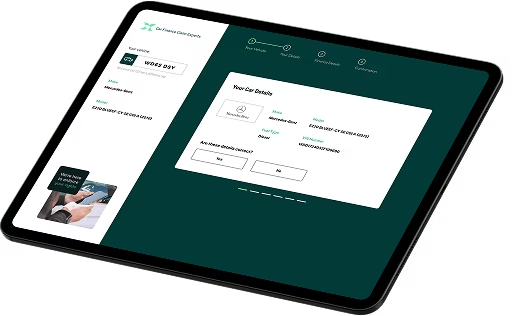

Check if you’re eligible

The first step is to check your eligibility to see if you were mis-sold on your finance agreement. You can use our quick and easy online checker to determine if the agreement may have involved unfair commission. To get started, you only need the lender’s name or your vehicle registration number, and the checker will search for your agreements. The system will then ask for information such as the type of agreement, when you took out the agreement, and the purchase cost to determine your eligibility.

Start your claim

If you are eligible, you can start the formal process of submitting a claim to your lender. You can directly approach the lender yourself for free or instruct a law firm like ours to manage the claim on your behalf. Acting swiftly and submitting strong supporting evidence from the beginning will avoid unnecessary delays.

Leave your details with us

If you would like us to manage the claim on your behalf, please provide your contact information after using our online checker. Our system is designed to streamline the process, ensuring we receive the essential details needed to process a claim while minimising any hassle for claimants. This information allows us to verify your claim, contact the lender and act on your behalf.

We will assess your claim

Our experts will evaluate your claim, ensure we have all the necessary information to win your case, and calculate the amount we believe you were mis-sold. We will keep you updated on progress and contact you if we need further information or supporting documents while preparing your case for submission to the lender.

We will submit your claim

We will submit a formal complaint to the lender once we have all the necessary information. We recommend getting your claim in as soon as possible so you can receive your compensation payout as soon as possible when the FCA's redress scheme launches in early 2026.

Delivering your compensation

If you are eligible for compensation under the FCA's redress scheme, we will be in touch to notify you about your compensation, including how much you will get and when. We will ensure payment is made to your chosen bank account as soon as possible.

How To Start Your Claim

SSL data encryption